Real Estate

Fund Portrait

WHY INVEST IN THE CARE HOME AND SPECIALISED HEALTHCARE MARKETS?

The care home sector is anti-cyclical and has a low correlation with the generally offered “economy driven” investments. Increasing demand due to the aging population and the lack of supply, combined with continuous backing of the sector by public policies supports long-term positive prospects of the asset class. Real estate investments in the sector offer above average returns, supported by stable and long-term cash flows.

WHY THREESTONES CAPITAL ?

Threestones Capital Management S.A. (TSC), founded in 2009, is an authorized Alternative Investment Fund Manager (AIFM) headquartered in Luxembourg. The company manages EUR 2 billion in four regulated investment vehicles under the supervision of the Luxembourg financial authorities (CSSF). TSC primarily focuses on real estate investments across Europe, targeting niche asset classes like nursing homes.

TSC is an experienced manager who has consistently delivered on target returns (13%+ net IRR and 1.6-1.8X net multiple). TSC Eurocare IV Fund follows the same strategy as TSC’ previous funds. The company has completed more than 100 transactions in the sector in the last 10 years (mostly single transactions) and is working with more than 25 nursing homes operators in Europe.

| INVESTMENT MANAGER | Threestones Capital Management SA (AIFM) |

|---|---|

| LINKEDIN COMPANY PAGE | Threestones Capital Management SA |

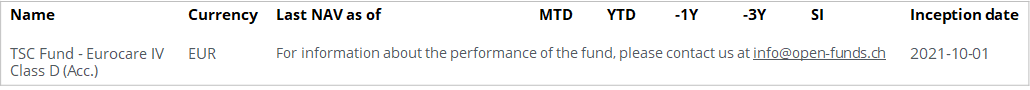

| FUND | TSC Eurocare IV |

| TYPE STRUCTURE | Luxembourg Closed‐end SICAV-SIF (regulated) |

| DOMICILE | Luxembourg |

| LAUNCH DATE | Oct. 2021 |

| DISTRIBUTOR SWITZERLAND | OpenFunds Investment Services AG |

| AUDITOR | Ernst & Young |

| CUSTODIAN | Banque de Luxembourg |

| REGULATOR | Commission de Surveillance du Secteur Financier, Luxembourg (CSSF) |

| AREAS OF INVESTMENT | Germany, Italy, Spain |

| STRATEGY | European care homes |

| CURRENCY | EUR |

| MINIMUM INVESTMENTS | Class A ordinary shares: EUR 125,000 / Class B ordinary shares: EUR 1,000,000 / Class C ordinary shares: EUR 10,000,000 |

| MANAGEMENT FEE | Class A ordinary shares: 1.2% / Class B ordinary shares: 1.0% / Class C ordinary shares: 0.8% |

| PERFORMANCE FEE | 100% to LPs up to 6% IRR (Preferred Return) / Catch up GP, 20% of Preferred Return received by the LPs / 80% to LPs and 20% to GP thereafter |

| TARGET NET IRR | > 10 - 12% (net of costs and fees) |

| TARGET DISTRIBUTION | 3% to 4% p.a. (paid quarterly) |

| LEVERAGE | Max. 50% of GAV |

| FUND TERM | 6 years (+1+1 extension) |

| TARGET FUND SIZE | EUR 500m equity (AuM 1bn) |

| ISIN | Class A Dis: LU2298599940 / Class B Dis: LU2298600037 / Class C Dis: LU2298600110 / Class D Ord Cap: LU2364760657 / Class E Ord Cap: LU2364760731 |

| SFDR CLASSIFICATION | Art. 8 |

Threestones Capital acquires two new properties in Germany for TSC Fund - Eurocare IV

14 September 2023Threestones Capital acquires a nursing home in Catalonia, Spain for TSC Fund – Eurocare IV (Press release)

Jan. 2023Alternative Investment in Healthcare: Transitioning from Niche to an Established Asset Class by Francesco Sparaco, Founding Partner at Threestones Capital (LPEA Magazine)

Dec. 2022Threestones healthcare fund buys Spanish nursing home (React News)

Oct. 2022Will Orpea scandal hit care home prices?

Feb. 3, 2022Threestones to raise fourth healthcare real estate fund targeting €1b AUM (Property EU)

Mar 2021Swiss Life - Press release

Mar. 2021Threestones adopts a "Best in Progress" investment strategy in the global real estate market, aiming to improve properties' technical features, increase care beds availability, and ensure compliance with safety regulations. They prioritize responsible allocation of capital to achieve environmental and social goals while delivering sustainable financial returns. Threestones is affiliated with sustainability institutions like UN Principles for Responsible Investing and follows SFDR regulations. They integrate ESG (Environmental, Social, and Governance) factors into their investment strategy through a Sustainability Committee. Threestones identifies and monitors sustainability risks, applies ESG criteria in investment decision-making, and tracks ESG performance indicators. Their remuneration policy incentivizes sound risk management and considers ESG factors in employee assessments. Threestones is committed to international standards and reports annually through initiatives like GRESB.

Eurocare IV is an Article 8 fund in terms of the classifications created by the European Union's Sustainable Finance Disclosure Regulation (SFDR), i.e. a fund promoting environmental or social characteristics alongside traditional financial returns.